Analyzing Your A/R in Dentrix

Dentrix helps you focus your collections efforts by analyzing your practice’s accounts receivable (A/R) and tracking family and insurance balances. Using the Practice Advisor Report, you can determine how your practice is collecting your A/R ; then, by running the Insurance Aging Report and Aging Report, you’ll know which insurance companies and patients to contact.

To analyze your A/R

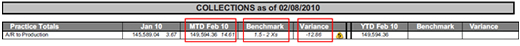

1. Open the Practice Advisor from the Office Manager, click Practice Advisor Report, set up the desired report options (making sure Collections is selected), and then click Preview to generate the Practice Advisor Report. Go to the Collections section.

The A/R to Production ratio in the MTD (month-to-date) column should not be more than 1.5 to 2 times the production during the same time frame. A negative number in the Variance column indicates that your collections are too low.

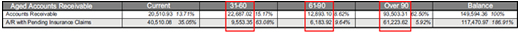

The Accounts Receivable row shows the account balance totals in each aging bracket.

The A/R with Pending Insurance Claims row shows the balance totals for pending claims in each aging bracket.

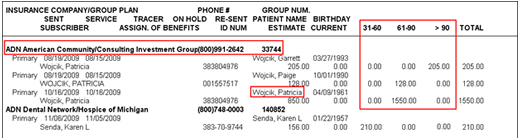

2. In the Office Manager, from the Reports menu, point to Ledger and then click Insurance Aging Report. Set up the desired options (make sure to select the aging you want to view under Minimum Days Past Due), and then click OK. You can preview the Insurance Aging Report from the Batch Processor.

The report lists each insurance carrier, the aged balances for each outstanding claim and the patients for whom those claims were submitted.

3. Contact the insurance companies to find out the reasons for the delay in payment so that those issues can be resolved and you can get paid.

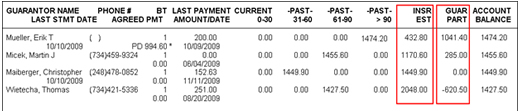

4. In the Office Manager, from the Reports menu, point to Ledger and then click Aging Report. Set up the desired options (making sure Standard Aging is selected), and then click OK. You can preview the Aging Report from the Batch Processor.

For each guarantor on the report, you can see how much of the Account Balance belongs to the family (Guar Part) and how much is due from insurance (Insr Est).

5. Contact guarantors with outstanding balances to collect payments.

For more information about analyzing your A/R in Dentrix, view the Insurance and Collections tutorial, the Generating Key Reports tutorial and the Accounts Receivable Reports webinar in the Dentrix Resource Center. You can also download a copy of the Dentrix G4 Reports Reference.

Author: Gentry Winn

Published: 09/07/2010

Contact Us

Contact Us Phone:

Phone:  Email

Email Request Demo

Request Demo