Simplify Collections using the Collections Manager

To be successful in your practice, you not only have to provide superior patient care, you have to manage your patient accounts efficiently. Sometimes, despite your best efforts, collecting on accounts can be difficult. The balancing act becomes increasing your collection rate while reducing the number of accounts that become bad debts.

Business consultants agree that account balances should not extend past 30 days. Beyond that time frame, the likelihood of collecting these debts decreases every day. The Dentrix Collections Manager helps you to follow up on past-due accounts by generating a list of accounts based on criteria you specify. Criteria can include account balance, account aging, insurance claim aging, minimum balance, and last payment date. You can then set priorities to determine which accounts you want to focus on first.

With the Collections Manager you can generate interactive lists from which you can contact patients in alternative ways such as through letter merge or email. You can also access patient account information using Dentrix tools such as the Office Journal, guarantor notes fields, and billing statements.

Before you can generate lists in the Collections Manager, you need to determine which information to include in your view. Once the view is set up, you can sort the Collections Manager list according to the columns you choose to display and filter your accounts according to the criteria you determine is most important.

For example, let’s say that you wanted to use the Collections Manager to create a view that shows a list of patients who are more than 30 days past due, and who haven’t made a payment in 30 days.

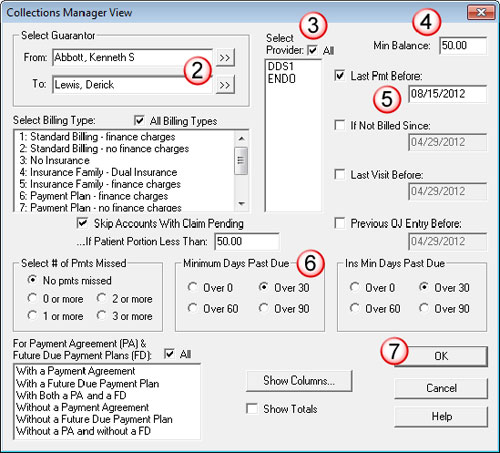

- From the Office Manager, click the Collections Manager button. The Collections Manager View dialog box appears.

- Specify a range of guarantors that you want to include in the list.

Note: The default is to list all guarantors, but depending on the size of your patient database, you may want to restrict the list to a certain range of last names, making the list more manageable, for instance guarantors last names A-J. - Select the provider(s) you want the list to include.

- Enter a Min. Balance amount you want the Collections Manager to include.

Note: Be sure to weigh the costs of collecting a debt against the amount of the debt. Is it worth your time and effort to try and collect account balances that are less than $25? - Check the box next to Last Pmt Before and enter a date 30 days prior to today’s date.

- In the Minimum Days Past Due group box, select Over 30.

- Click OK to generate the list.

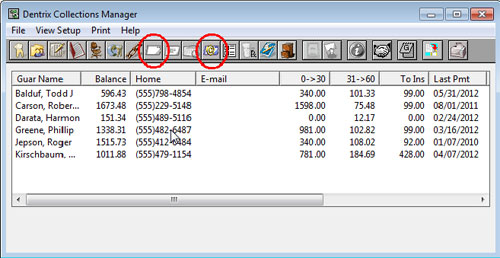

Once you have generated a workable list, you can then choose how to contact these accounts. You can click the Quick Letters or Send Message buttons on the Collections Manager toolbar to contact patients by letter or email message respectively or you can make a phone call.

By making the use of the Collections Manager part of your office routines, you have the ability to stay on top of your accounts before the account balances become uncollectable.

For more information about using the Collections Manager, see the following topics in the Dentrix Help: Collections Manager Overview, and Setting up a View for Collections Manager. Log in to the Dentrix Resource Center and view the webinar recordings titled Collections Management, and Treatment Manager and Collection Manager.

Author: Sean Eyring

Published: 09/30/2012

Contact Us

Contact Us Phone:

Phone:  Email

Email Request Demo

Request Demo